Qualified Opportunity Zone Funds

Spurring Economic Develpment and Job Creation

“We want all Americans to experience the dynamic opportunities being generated by President Trump’s economic policies. We anticipate that $100 billion in private capital will be dedicated towards creating jobs and economic development in Opportunity Zones. This incentive will foster economic revitalization and promote sustainable economic growth, which was a major goal of the Tax Cuts and Jobs Act”. US Dept. of Treasury, Steven T. Mnuchin Secretary of the Treasury, October 19, 2018.Sweeping Legislation

The “Investing in Opportunity Act” included in the Tax Cuts and Jobs Act, passed in December 2017, introduced an innovative way to stimulate private investment in low income communities. The program rewards investors with significant tax savings for their commitment of long-term investing in qualified opportunity zones.

Each state governor was provided the opportunity to

select up to 25 percent of the Qualified Opportunity Zones

(“QOZ”) in their jurisdictions to develop economically

depressed areas. To qualify, the area needed to meet

certain low-income requirements including a higher than

20 percent poverty rate or a prevailing median family

income less than 80 percent of the metropolitan median

family income, based upon the most recent census tract

data (2010).

In total, over 8,700 QOZs, home to more than 35 million

Americans, were designated in 50 states, Washington

D.C., and U.S. territories. In the aggregate, the designated

QOZs, as certified by the Treasury Department, manifest

an average poverty rate of 31 percent and a median

family income of 59 percent relative to its applicable area.

Approximately 75 percent of QOZs are located within

metropolitan areas.

Tax Advantages

Potential Tax Benefits of Investing in Qualified Opportunity Zones

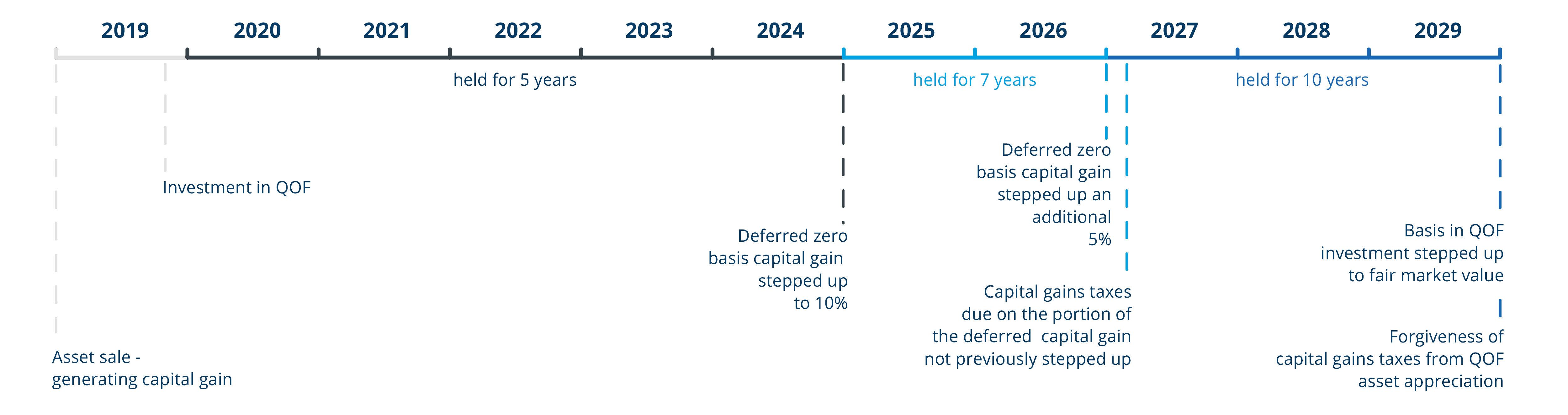

Qualified opportunity zone fund investors access a powerful suite of tax incentives including capital gains tax deferral, a step up in basis and tax-free growth. If an investor sells any asset that generates a capital gain and has invested an equal or lesser amount in a QOF within 180 days, they could enjoy the following benefits:Tax free growth

Once invested in a Qualified Opportunity Zone Fund, any capital gains tax on realized appreciation in the QOF will be tax free provided that the investor's holding period reaches ten years. The Qualified Opportunity Zone legislation was designed to incentive private sector investment in distressed communities.

Tax reduction

The taxable gain is reduced by ten percent, with an additional five percent reduction if the investment is held for a seven year period. In order to qualify for the additional five percent gain reduction, the QOF investment must have been made in the 2019 tax year.

Tax deferral

The initial capital gain tax from the sale of any asset, where the equal or lesser amount is invested in a qualified opportunity zone within 180 days, can be deferred. Investors are not required to invest the basis from the original investment in order to receive the deferral benefit.

QOZ Investment Timeline

Understanding the three tax benefits.

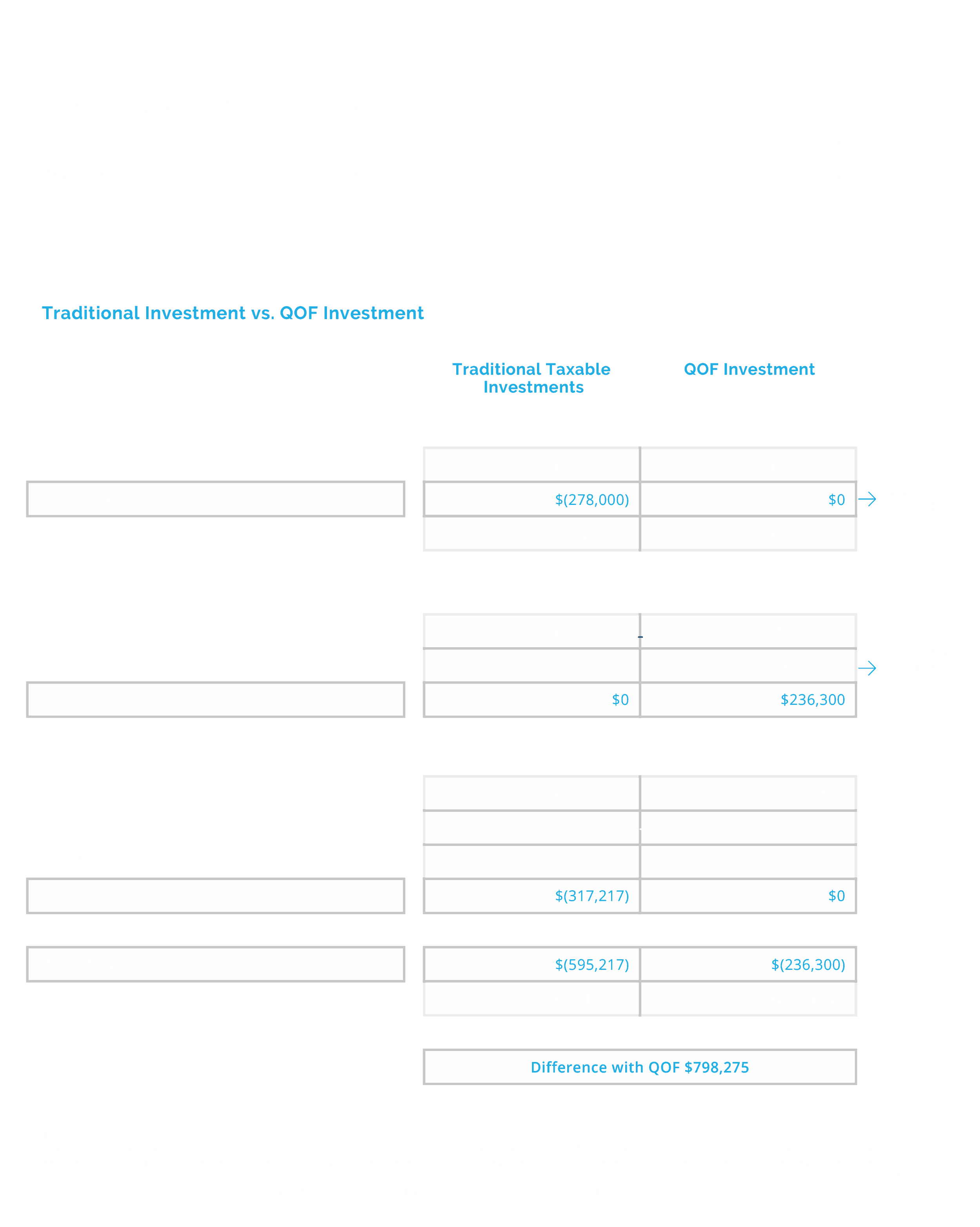

QOZ Investment Comparison

Scenario planning Qualified Opportunity Funds.

Consider the risks

Qualified Opportunity Zone Funds also carry risks.

Investing in qualified opportunity zones involve substantial risk. It's important to understand the specific risks associated with a Qualified Opportunity Zone Fund investment before you make investment decisions. QOF investments involve complicated tax concepts, reporting and tracking requirements which should be evaluated in conjunction with qualified tax, legal and financial representation. Stax Capital does not provide tax guidance or advice.Deferred Capital Gains.

Remember that Capital Gains tax will be due and payable in 2027. Investors must plan for this event .

Tax will be due.Speculative investments.

Qualified Opportunity Zone Funds are speculative in nature and heavily reliant on the assumptions used by investment sponsors which may prove to be inaccurate.

Risk is inherent.Illiquid investment.

No public market currently exists, and one is unlikely to develop. Selling an interest in a Qualified Opportunity Zone Fund may prove to be difficult or impossible.

Difficult to sell.Real estate risks.

Investments in real estate are subject to various economic risks including among other things recession, inflation, supply and changing market demographics.

Understand real estate risks.Potential returns

The amount and timing of investments in qualified opportunity zones distributions are not guaranteed. There is no guarantee that investors will receive distributions or a return of capital.

No guarantees.Economic risks

Disruptions in the financial markets and challenging economic conditions could adversely affect investing in qualified opportunity zones.

Economic impact.Tax Risks

Tax rules and guidelines for qualified opportunity zone fund investing have not been finalized and subsequent changes to QOZ rules and guidelines may have material adverse consequences to qualified opportunity zone funds and their investors.

Regulatory Risk

The regulatory framework governing QOZ investing is fluid and changes are ongoing. Subsequent changes to QOZ and QOF regulations may have material adverse consequences to QOF Funds and their investors.

QOZ Uncertainty

Qualified Opportunity Zone Fund tax laws are new and untested and subject to substantial modifications which creates a high level of uncertainty. Changes to tax laws may have material adverse consequences to QOF Funds and their investors.

VIEW LIVE OFFERINGS

Browse unique investment strategies

available to our accredited clients

Completed Investments

| CF Texas Portfolio Multifamily DST

2 - Dallas-Fort Worth, TX 1 - Houston, TX |

|

| Total Capital Placement $94,811,000 |

|

| Loan to value 53.0% |

|

| 1031 Eligible Yes |

|

| Minimum Investment $250,000 |

|

|

Type 1031 DST |

Structure DST |

| Passco Vecina DST

San Antonio, TX |

|

| Total Capital Placement $35,875,000 |

|

| Loan to value 52.39% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Passco Braselton DST

Buford, GA |

|

| Total Capital Placement $37,675,000 |

|

| Loan to value 52.34% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| CF Riverview Multifamily DST

Dayton, KY |

|

| Total Capital Placement $38,475,000 |

|

| Loan to value 50.0% |

|

| 1031 Eligible Yes |

|

| Minimum Investment $100,000 |

|

|

Type 1031 DST |

Structure DST |

| CPA Cue Luxury Apartments DST

Cypress, TX |

|

| Total Capital Placement $21,000,000 |

|

| Loan to value 57.4% |

|

| 1031 Eligible Yes |

|

| Minimum Investment $100,000 |

|

|

Type 1031 DST |

Structure DST |

| CF Valencia Life Sciences DST

Valencia, CA |

|

| Total Capital Placement $40,400,000 (90% of total DST interests) |

|

| Loan to value 55.15% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 250k Cash - 250k Exchange |

|

|

Type 1031 DST |

Structure DST |

| MCG Asheville DST

Arden, NC |

|

| Total Capital Placement $33,305,495 |

|

| Loan to value 48.93% |

|

| 1031 Eligible Yes |

|

| Minimum Investment $25,000 |

|

|

Type 1031 DST |

Structure DST |

| GSI Hilton Head II DST

Ridgeland, SC |

|

| Total Capital Placement $21,129,341 |

|

| Loan to value 0.00% |

|

| 1031 Eligible Yes |

|

| Minimum Investment $25,000 |

|

|

Type 1031 DST |

Structure DST |

| CX Multifamily Portfolio DST

Grovetown, GA | Fairhope, AL |

|

| Total Capital Placement $67,319,313 |

|

| Loan to value 47.67% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Passco Collins DST

Covington, LA |

|

| Total Capital Placement $32,800,000 |

|

| Loan to value 52.33% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| CF Glenmuir Multifamily DST

Naperville, IL |

|

| Total Capital Placement $86,100,000 |

|

| Loan to value 27.73% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 250k Cash - 250k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Passco Altis Promenade DST

Lutz, FL |

|

| Total Capital Placement $54,300,000 |

|

| Loan to value 47.56% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Trilogy Park 205 DST

Park Ridge, IL |

|

| Total Capital Placement $25,653,786 |

|

| Loan to value 52.33% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Passco Little Rock DST

Little Rock, AR |

|

| Total Capital Placement $34,125,000 |

|

| Loan to value 53.10% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| CF Summerfield Multifamily DST

Landover, MD |

|

| Total Capital Placement $38,100,000 (75% of total DST interests) |

|

| Loan to value 60.1% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 250k Cash - 250k Exchange |

|

|

Type 1031 DST |

Structure DST |

| NexPoint Storage I DST

Miami MSA, Atlanta MSA, Orlando MSA, Jacksonville MSA |

|

| Total Capital Placement $85,892,414 |

|

| Loan to value 43.08% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| CF Wyatt Multifamily DST

Fort Collins, CO |

|

| Total Capital Placement $63,785,000 |

|

| Loan to value 47.1% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Passco Chesterfield DST

Chesterfield, MO |

|

| Total Capital Placement $57,425,000 |

|

| Loan to value 48.42% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| CX Lullwater at Blair Stone DST

Tallahassee, FL |

|

| Total Capital Placement $27,236,208 |

|

| Loan to value 53.52% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Passco Mill at New Holland DST

Gainesville, GA |

|

| Total Capital Placement $38,775,000 |

|

| Loan to value 47.97% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Inland Wauwatosa DST

Wauwatosa, WI |

|

| Total Capital Placement $23,026,079 |

|

| Loan to value 53.13% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Passco San Antonio DST

San Antonio, TX |

|

| Total Capital Placement $36,250,000 |

|

| Loan to value 47.02% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| CX Evergreens at Mahan DST

Tallahassee, FL |

|

| Total Capital Placement $33,792,545 |

|

| Loan to value 58.07% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| CX Station at Savannah Quarters DST

Pooler, GA |

|

| Total Capital Placement $21,173,843 |

|

| Loan to value 57.14% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| CF Station Multifamily DST

Las Colinas, TX |

|

| Total Capital Placement $57,354,000 |

|

| Loan to value 50.70% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| CX Station at Poplar Tent DST

Concord, NC |

|

| Total Capital Placement $27,631,804 |

|

| Loan to value 57.49% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Income & Opportunity Fund

United States and International |

|

| Total Capital Placement $100,000,000 |

|

| Loan to value 50%-70% LTV Target |

|

| 1031 Eligible no |

|

| Minimum Investment $50,000 |

|

|

Type Real Estate |

Structure LLC |

| Multi-family DST

Memphis, TN |

|

| Total Capital Placement $32,427,087 |

|

| Loan to value 56.26% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Zero Coupon DST

Tucson, AZ |

|

| Total Capital Placement $35,306,051 |

|

| Loan to value 82.13% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type 1031 DST |

Structure DST |

| Income & Opportunity Fund

Southern United States |

|

| Total Capital Placement $200,000,000 |

|

| Loan to value 65-75% LTV Target |

|

| 1031 Eligible no |

|

| Minimum Investment $50,000 |

|

|

Type Real Estate |

Structure LLC |

| Multi-family Fund

US |

|

| Total Capital Placement $200,000,000 |

|

| Loan to value 65-75% |

|

| 1031 Eligible no |

|

| Minimum Investment $50,000 |

|

|

Type Real Estate |

Structure LLC |

| Multi-family DST

Burlington, NC |

|

| Total Capital Placement $18,708,724 |

|

| Loan to value 57.49% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type Real Estate |

Structure DST |

| Multi-Family DST

N/A |

|

| Total Capital Placement $10,000,000 |

|

| Loan to value $234234234 |

|

| 1031 Eligible Yes |

|

| Minimum Investment $25,000 |

|

|

Type MultiFamily |

Structure LLC |

| Multi-family DST

St. Louis, MO |

|

| Total Capital Placement $24,480,000 |

|

| Loan to value 49.71% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type Real Estate |

Structure DST |

| SENIOR LIVING DST

Phoenix, AZ |

|

| Total Capital Placement $53,544,255 |

|

| Loan to value 0.00% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type Real Estate |

Structure DST |

| MULTI-FAMILY DST

|

|

| Total Capital Placement |

|

| Loan to value |

|

| 1031 Eligible Yes |

|

| Minimum Investment |

|

|

Type |

Structure |

| Multi-family DST

Las Vegas, NV |

|

| Total Capital Placement $58,277,704 |

|

| Loan to value 49.02% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type Real Estate |

Structure DST |

| MULTI-FAMILY DST

Nashville, TN |

|

| Total Capital Placement 22 |

|

| Loan to value $234234234 |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25 |

|

|

Type MultiFamily |

Structure DST |

| Multi-family DST

Vernon Hills, IL |

|

| Total Capital Placement $41,425,000 |

|

| Loan to value 58.00% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type Real Estate |

Structure DST |

| MULTI-FAMILY DST

Nashville, TN |

|

| Total Capital Placement $72,941,594 |

|

| Loan to value |

|

| 1031 Eligible Yes |

|

| Minimum Investment $25,000 |

|

|

Type MultiFamily |

Structure DST |

| Multi-family DST

Ponte Vedra Beach, FL |

|

| Total Capital Placement $28,525,000 |

|

| Loan to value 55.58% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type Real Estate |

Structure DST |

| Multi-family DST

Naperville, IL |

|

| Total Capital Placement $46,550,000 |

|

| Loan to value 56.75% |

|

| 1031 Eligible no |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type Real Estate |

Structure DST |

| MULTI-FAMILY DST

|

|

| Total Capital Placement |

|

| Loan to value |

|

| 1031 Eligible Yes |

|

| Minimum Investment |

|

|

Type |

Structure |

| MULTI-FAMILY DST

|

|

| Total Capital Placement |

|

| Loan to value |

|

| 1031 Eligible Yes |

|

| Minimum Investment |

|

|

Type |

Structure |

| HOSPITALITY DST

Detroit, MI |

|

| Total Capital Placement $32,368,270 |

|

| Loan to value 43.58% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type Real Estate |

Structure DST |

| MULTI-FAMILY DST

|

|

| Total Capital Placement |

|

| Loan to value |

|

| 1031 Eligible Yes |

|

| Minimum Investment |

|

|

Type |

Structure |

| Multi-family DST

Aurora, IL |

|

| Total Capital Placement $37,630,000 |

|

| Loan to value 57.43% |

|

| 1031 Eligible Yes |

|

| Minimum Investment 25k Cash - 100k Exchange |

|

|

Type Real Estate |

Structure DST |

| Multi-family DST

|

|

| Total Capital Placement |

|

| Loan to value |

|

| 1031 Eligible Yes |

|

| Minimum Investment |

|

|

Type |

Structure |

| Multi-family DST

|

|

| Total Capital Placement |

|

| Loan to value |

|

| 1031 Eligible Yes |

|

| Minimum Investment |

|

|

Type |

Structure |

| Multi-family DST

|

|

| Total Capital Placement |

|

| Loan to value |

|

| 1031 Eligible Yes |

|

| Minimum Investment |

|

|

Type |

Structure |

| Multi-family DST

|

|

| Total Capital Placement |

|

| Loan to value |

|

| 1031 Eligible Yes |

|

| Minimum Investment |

|

|

Type |

Structure |

| Multi-family DST

|

|

| Total Capital Placement |

|

| Loan to value |

|

| 1031 Eligible Yes |

|

| Minimum Investment |

|

|

Type |

Structure |

| Multi-family DST

|

|

| Total Capital Placement |

|

| Loan to value |

|

| 1031 Eligible Yes |

|

| Minimum Investment |

|

|

Type |

Structure |

| Multi-family DST

Nashville, TN |

|

| Total Capital Placement |

|

| Loan to value $75,945 |

|

| 1031 Eligible Yes |

|

| Minimum Investment $75,945,000 |

|

|

Type |

Structure Development |